For consultants, the best accounting software is QuickBooks Online. It offers easy expense tracking and invoicing.

It also integrates with other business tools. As a consultant, managing your finances is crucial for the success of your business. Finding the right accounting software can streamline your processes and help you stay organized. With the right software, you can track expenses, generate invoices, and manage your financial data efficiently.

One of the top choices for consultants is QuickBooks Online, a user-friendly platform that offers a range of features to meet your accounting needs. We will explore the benefits of using QuickBooks Online as a consultant and how it can help you streamline your financial management.

Introduction To Accounting Software For Consultants

Discover the top accounting software options designed specifically for consultants. Streamline your financial management and reporting with these powerful tools tailored to meet your unique needs.

Why Consultants Need Specialized Accounting Tools

Consultants are always on the go, meeting clients, attending seminars, and managing their businesses. It can be challenging to keep track of their financial transactions and manage their finances efficiently. Hence, specialized accounting tools can make their lives easier by automating their financial processes, reducing the risk of errors, and saving time.

Benefits Of Streamlining Your Financial Processes

Streamlining financial processes is critical for consultants to manage their businesses effectively. It helps them stay organized, make informed decisions, and focus on their core activities. Some of the benefits of using specialized accounting software for consultants are:

- Automated invoicing and payment reminders reduce the time spent on manual tasks.

- Real-time financial reports provide insights into the financial health of the business.

- Expense tracking helps in managing expenses and maximizing tax deductions.

- Integration with other tools such as project management software helps in managing projects efficiently.

- Easy collaboration with accountants and bookkeepers reduces the risk of errors and ensures compliance.

In conclusion, specialized accounting software is essential for consultants to manage their financial processes effectively. It saves time, reduces the risk of errors, and provides valuable insights into the financial health of their businesses. By streamlining their financial processes, consultants can focus on their core activities and grow their businesses.

Essential Features In Accounting Software For Consultants

When it comes to accounting software for consultants, there are essential features that can greatly enhance productivity and efficiency. These features include time tracking capabilities, invoicing and payment processing, expense management, and financial reporting and analytics.

Time Tracking Capabilities

Time tracking capabilities are crucial for consultants to accurately record the time spent on client projects. The best accounting software for consultants should offer easy-to-use time tracking tools that allow for precise time entry, project allocation, and reporting.

Invoicing And Payment Processing

Efficient invoicing and payment processing features are essential for consultants to streamline their billing processes. The accounting software should enable easy creation and customization of professional invoices, as well as seamless integration with various payment gateways for hassle-free transactions.

Expense Management

Effective expense management tools are vital for consultants to track and manage business expenses. The software should provide functionalities for capturing receipts, categorizing expenses, and generating expense reports, simplifying the reimbursement process and ensuring accurate financial records.

Financial Reporting And Analytics

Comprehensive financial reporting and analytics capabilities are indispensable for consultants to gain insights into their business performance. The software should offer customizable financial reports, real-time data visualization, and advanced analytics to support informed decision-making and strategic planning.

Comparing Popular Accounting Software Options

When it comes to managing finances, consultants need accounting software that is efficient, reliable, and tailored to their unique needs. With so many options available, it can be overwhelming to choose the right accounting software for your consulting business. In this article, we will compare four popular accounting software options: QuickBooks, FreshBooks, Xero, and Wave. Each software has its own strengths and features that make it suitable for different consulting needs.

Quickbooks For Versatility

QuickBooks is one of the most versatile accounting software options available for consultants. It offers a wide range of features, including invoicing, expense tracking, and financial reporting. With its user-friendly interface and customizable templates, QuickBooks allows consultants to easily manage their finances and stay organized.

Freshbooks For Simplicity

FreshBooks is a great option for consultants who value simplicity and ease of use. With its clean and intuitive interface, FreshBooks makes it easy to create and send professional-looking invoices, track expenses, and manage client payments. Consultants can also benefit from its time tracking feature, which allows them to accurately bill clients based on the time spent on each project.

Xero For Cloud-based Management

Xero is a cloud-based accounting software that offers consultants the convenience of accessing their financial data from anywhere, at any time. With its robust features like bank reconciliation, inventory tracking, and multi-currency support, Xero is a powerful tool for consultants who work with clients around the globe. The ability to collaborate with team members and share real-time financial data makes Xero an excellent choice for consultants who value efficiency and collaboration.

Wave For Cost-efficiency

Wave is a free accounting software option that is ideal for consultants looking for a cost-effective solution. Despite being free, Wave offers many essential features, including invoicing, expense tracking, and financial reporting. Consultants can also connect their bank accounts to Wave, making it easy to reconcile transactions and stay on top of their finances. While Wave may not have as many advanced features as some of the other software options, it is a reliable and budget-friendly choice for consultants.

Customization And Scalability

When it comes to choosing the best accounting software for consultants, customization and scalability are two crucial factors to consider. As a consultant, you need accounting software that can be tailored to your specific business needs and has the capability to grow with your consulting practice. In this section, we will explore how you can customize accounting software to suit your consulting business and the importance of scalability for future growth.

Tailoring Software To Your Consulting Business

One of the key advantages of using accounting software for consultants is the ability to customize it according to your unique business requirements. This customization allows you to streamline your accounting processes and ensure that the software aligns with your specific consulting practices.

Here are some ways you can tailor accounting software to your consulting business:

- Customize invoice templates to reflect your brand identity and include relevant details for your clients.

- Modify expense categories to align with your consulting expenses, making it easier to track and analyze your spending.

- Create custom reports and dashboards to gain insights into the financial health of your consulting business.

- Integrate the software with other tools you use, such as project management or CRM software, to streamline data flow and enhance efficiency.

Planning For Growth: Scalable Accounting Solutions

As a consultant, your goal is to expand your business and take on more clients. Therefore, it is crucial to choose accounting software that can scale alongside your growth. Scalable accounting solutions provide the flexibility to handle increased workloads, accommodate additional users, and manage larger volumes of financial data.

Here are some benefits of using scalable accounting software:

- Efficiently handle increasing numbers of clients and transactions without compromising on performance.

- Scale up or down as per your business needs, ensuring you only pay for the features and resources you require.

- Accommodate additional users as your consulting team expands, allowing for seamless collaboration and access to real-time financial data.

- Integrate with other software and tools to support your growing consulting ecosystem.

Choosing accounting software that offers customization and scalability ensures that your consulting business can adapt to changing needs and continue to thrive. By tailoring the software to your specific requirements and planning for future growth, you can effectively manage your finances, streamline processes, and focus on delivering exceptional consulting services.

Mobile Access And Cloud Integration

For consultants, the best accounting software offers mobile access and seamless cloud integration. This enables users to manage their finances on-the-go and access real-time data from anywhere, streamlining their operations and improving efficiency. With these features, consultants can stay connected and make informed decisions to drive their business forward.

As a consultant, you’re always on the move, meeting clients, and managing multiple projects. Therefore, accessing your accounting software from anywhere and at any time is crucial. That’s where mobile access and cloud integration come in handy.

Managing Finances On The Go

With mobile access, you can manage your finances on the go, whether you’re traveling, meeting clients, or working from home. Accounting software that provides mobile access allows you to access your financial data from your smartphone or tablet, giving you the flexibility to manage your finances on the go.

The Importance Of Real-time Data Sync

Real-time data sync is essential for businesses of all sizes, including consultants. With real-time data sync, you can access your financial data from any device, and any changes you make are updated instantly across all devices. This ensures that you always have access to the latest financial data, no matter where you are. When choosing an accounting software for your consultancy business, look for one that offers mobile access and cloud integration. With these features, you can manage your finances on the go and access your financial data from anywhere, at any time. Moreover, real-time data sync ensures that your financial data is always up-to-date, providing you with accurate insights into your business’s financial health.

Security Measures In Accounting Software

When it comes to accounting software for consultants, security measures play a vital role in safeguarding sensitive financial data. Let’s explore the key aspects of security in accounting software.

Protecting Sensitive Financial Data

Encryption: Protects data from unauthorized access.

Access Controls: Limit who can view and edit financial information.

Regular Backups: Ensure data is safe and recoverable in case of emergencies.

Compliance With Financial Regulations

Audit Trails: Track changes made to financial records for compliance.

User Permissions: Grant access based on roles to adhere to regulations.

Secure Authentication: Verify user identities to prevent unauthorized access.

User Experience And Customer Support

The best accounting software for consultants should not only be user-friendly but also provide excellent customer support. A smooth user experience coupled with top-notch customer service can make a significant difference in managing finances and growing a consulting business.

`ease Of Use For Non-accountants`

`access To Help And Resources`

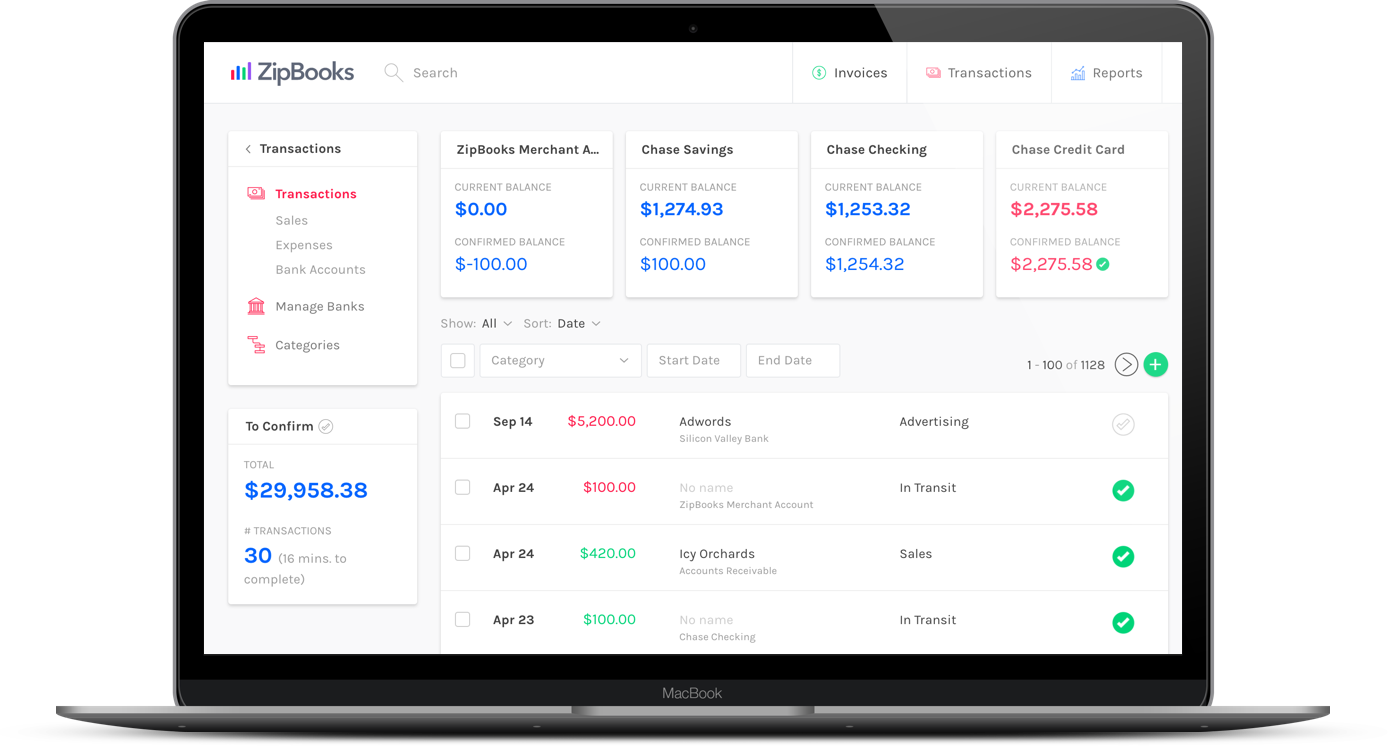

Credit: zipbooks.com

Making The Decision: Selecting The Right Software

When it comes to selecting the best accounting software for consultants, making the right decision is crucial for the success of your business. Here are some key considerations to keep in mind:

Assessing Your Business Needs

Determine your specific requirements and priorities before choosing an accounting software.

- Consider the size of your business and the complexity of your financial transactions.

- Identify the features you need, such as invoicing, expense tracking, and reporting.

- Look for software that can easily integrate with other tools you use.

Cost-benefit Analysis

Conduct a thorough cost-benefit analysis to ensure that the software aligns with your budget and offers sufficient value.

| Costs | Benefits |

|---|---|

| Subscription fees | Time-saving automation |

| Implementation costs | Improved accuracy and efficiency |

| Training expenses | Better financial insights |

Trial Periods And Demos

Take advantage of trial periods and demos to test the software and ensure it meets your needs.

- Evaluate the user interface and ease of use during the trial period.

- Engage with customer support to assess their responsiveness and helpfulness.

- Seek feedback from team members who will be using the software.

Integration With Other Business Tools

Integration with other business tools is crucial for consultants to streamline their workflow efficiently.

Connecting With Crm Systems

Accounting software that seamlessly integrates with CRM systems enhances client management.

Project Management Software Compatibility

Compatibility with project management tools simplifies task tracking and resource allocation.

Future Trends In Accounting Software For Consultants

Explore the latest trends in accounting software tailored for consultants, designed to streamline financial management tasks and improve efficiency. These advanced solutions offer customizable features, seamless integration with other tools, and enhanced security measures, empowering consultants to make well-informed business decisions.

As technology evolves, the accounting industry is also changing rapidly. With the help of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Blockchain, the accounting software industry is becoming more efficient, faster, and reliable. In this article, we will discuss the future trends in accounting software for consultants.

Ai And Machine Learning Innovations

AI and ML are transforming the accounting industry by automating tedious and repetitive tasks, such as data entry, bank reconciliation, and invoice processing. With the help of AI and ML, accounting software can now detect anomalies, trends, and patterns in financial data with great accuracy, making it easier for consultants to identify potential risks and opportunities for their clients. Moreover, AI-powered accounting software can provide real-time insights, forecasts, and predictions based on historical data, helping consultants to make informed decisions quickly. AI and ML are also improving the security of accounting software by detecting fraudulent transactions and preventing cyber-attacks.

The Rise Of Blockchain In Accounting

Blockchain is a distributed ledger technology that provides a secure and transparent way to record transactions. It has the potential to revolutionize the accounting industry by reducing the time, cost, and complexity of financial transactions. In accounting, blockchain can provide a secure and tamper-proof way to store financial data, ensuring that all parties have access to the same information. It can also automate the process of verifying transactions, reducing the need for intermediaries and saving time and money. Furthermore, blockchain can enable smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This can improve the efficiency of financial transactions and reduce the risk of errors and disputes. In conclusion, the future of accounting software for consultants is bright, with AI, ML, and blockchain leading the way. By embracing these technologies, consultants can provide more value to their clients, improve the accuracy and reliability of their work, and stay ahead of the competition.

Conclusion: Elevating Your Consulting Practice

Elevate your consulting practice with the best accounting software tailored for consultants. Streamline your financial management with user-friendly and efficient tools designed to enhance your productivity and accuracy. Boost your consultancy’s success by making informed decisions and optimizing your financial operations.

Recap Of Key Benefits

Throughout this blog post, we have explored the best accounting software options available for consultants. Now, let’s recap the key benefits of investing in these tools to elevate your consulting practice.

- Simplified Financial Management: With the right accounting software, you can streamline your financial processes, track expenses, and generate accurate reports effortlessly.

- Time and Cost Savings: By automating tasks like invoicing, expense tracking, and tax calculations, accounting software frees up your valuable time and reduces the need for hiring additional staff.

- Improved Accuracy: Manual data entry is prone to errors, which can lead to costly mistakes. Accounting software automates calculations and reduces the risk of human error, ensuring accurate financial records.

- Enhanced Client Relationships: Professional-looking invoices, detailed financial reports, and timely delivery of financial information can impress your clients and strengthen your business relationships.

- Real-Time Insights: Access to up-to-date financial data and performance metrics empowers you to make informed decisions and strategize effectively for the growth of your consulting practice.

Final Thoughts On Investing In Your Financial Health

As a consultant, your financial health directly impacts the success of your practice. By investing in the best accounting software, you can streamline your financial management processes, save time and costs, and improve accuracy. These tools not only enhance your efficiency but also elevate your professional image and client relationships.

Remember, choosing the right accounting software is crucial. Evaluate your specific needs, consider factors like scalability, integration capabilities, and user-friendliness. Take advantage of free trials, demos, and user reviews to make an informed decision.

Ultimately, investing in your financial health with the best accounting software will position you for long-term success as a consultant. Embrace these tools, stay organized, and focus on what you do best – providing top-notch consulting services to your clients.

Credit: www.techrepublic.com

Frequently Asked Questions

What Is The Most Used Accounting Software?

The most used accounting software is QuickBooks, known for its user-friendly interface and robust features. It is widely utilized by businesses for its efficiency in managing finances and generating reports. QuickBooks offers various versions to cater to different business needs, making it a popular choice in the accounting industry.

What Is The Best Accounting Software For Education Consulting?

The best accounting software for education consulting is QuickBooks Online. It offers features for invoicing, expense tracking, and financial reporting, making it ideal for managing finances in the education consulting industry. With its user-friendly interface and customizable options, QuickBooks Online is a top choice for education consultants.

Do You Need Your Cpa For Consulting?

No, a CPA is not required for consulting. While having a CPA can be beneficial, it is not mandatory for consulting work. Consulting is a broad field that encompasses various specialties, and many consultants without a CPA excel in their respective areas of expertise.

What Software Do Corporate Accountants Use?

Corporate accountants commonly use software such as QuickBooks, Xero, and SAP for financial management and reporting. These tools help streamline accounting processes, manage transactions, and generate financial statements efficiently.

Conclusion

To sum up, selecting the best accounting software for consultants is crucial for efficient financial management. With the right software in place, consultants can streamline their invoicing, expense tracking, and reporting processes, ultimately saving time and improving accuracy. From the various options available, it is important to consider factors such as user-friendliness, scalability, and integration capabilities.

By carefully assessing these factors and choosing the software that aligns with their specific needs, consultants can enhance their financial operations and focus on delivering exceptional services to their clients.