For multiple businesses, QuickBooks Online is the best accounting software due to its robust features and multi-entity support. With its intuitive interface and ability to handle complex financial needs, QuickBooks Online is the top choice for businesses managing multiple entities or locations.

Running multiple businesses can be challenging, especially when it comes to managing finances. Finding the right accounting software that can effectively handle the financial needs of multiple entities is crucial for seamless operations. We will explore the best accounting software options for multiple businesses, focusing on their key features and benefits.

By the end, you will have a clear understanding of the top accounting software solutions that can streamline financial management for your multiple businesses. Let’s dive in and find the perfect accounting software to meet your business needs.

Introduction To Multi-business Accounting

Managing multiple businesses can be a challenging task, especially when it comes to accounting. Keeping track of financial transactions, tax compliance, and reporting for each business can be overwhelming. Therefore, it is essential to have robust accounting software that can handle multiple businesses efficiently. In this blog post, we will discuss the challenges of managing multiple businesses and the importance of using the best accounting software for multi-business accounting.

Challenges Of Managing Multiple Businesses

Managing multiple businesses means dealing with multiple sets of financial records, accounts payable and receivable, taxes, and other financial transactions. This complexity can lead to many challenges, including:

- Difficulty in keeping track of financial transactions for each business

- Increased risk of errors in financial reporting

- Difficulty in ensuring tax compliance for each business

- Time-consuming and repetitive tasks

- Lack of visibility into the financial health of each business

The Importance Of Robust Accounting Software

To overcome the challenges of managing multiple businesses, it is crucial to have robust accounting software that can handle multiple businesses simultaneously. The best accounting software for multi-business accounting should have the following features:

| Features of Robust Accounting Software for Multi-Business Accounting |

|---|

| Ability to handle multiple businesses simultaneously |

| Easy integration with other business systems |

| Automated financial reporting and tax compliance |

| Customizable reporting and dashboard for each business |

| Secure and reliable data storage and backup |

With robust accounting software, managing multiple businesses becomes easier, more efficient, and less time-consuming. It provides a clear view of the financial health of each business, enabling business owners to make informed decisions and take necessary actions. Therefore, it is essential to choose the best accounting software for multi-business accounting to ensure the smooth running of multiple businesses.

Key Features To Look For

When choosing the best accounting software for multiple businesses, it’s crucial to consider key features that can streamline your financial management processes and support your business growth. Here are the essential features to look for:

Multi-entity Support

Choose accounting software that offers robust support for managing multiple entities within a single system. It should allow you to track and manage the finances of each business separately while providing consolidated reporting for a comprehensive view of your overall financial performance.

Scalability And Flexibility

Look for accounting software that can scale alongside your business growth. It should be flexible enough to accommodate changes in the number of entities, transactions, and users without compromising performance. The ability to customize workflows and reporting to meet the specific needs of each business is also essential.

Integration Capabilities

Seek accounting software that seamlessly integrates with other essential business tools, such as CRM systems, payroll software, inventory management, and e-commerce platforms. Integration capabilities ensure smooth data flow across different systems, eliminating the need for manual data entry and reducing the risk of errors.

Security And Compliance

Ensure that the accounting software prioritizes data security and compliance with industry regulations. Look for features such as role-based access controls, data encryption, audit trails, and regular software updates to protect sensitive financial information. Additionally, the software should adhere to relevant accounting standards and tax laws.

Top Accounting Software Options

Choosing the right accounting software is crucial for managing finances effectively across multiple businesses. With a myriad of options available, it can be overwhelming to find the perfect fit. To help you make an informed decision, we have compiled a list of the top accounting software options that cater to different business needs. Whether you are an industry giant or a small business owner, these software solutions offer a range of features and benefits to streamline your accounting processes.

Quickbooks Online: An Industry Standard

QuickBooks Online is widely recognized as the industry standard for accounting software. Its user-friendly interface and comprehensive features make it an ideal choice for businesses of all sizes. With QuickBooks Online, you can track income and expenses, manage invoices, and generate financial reports effortlessly. The software also offers seamless integration with various third-party applications, allowing you to streamline your workflow and automate repetitive tasks. Whether you are a sole proprietor or a multinational corporation, QuickBooks Online provides the tools you need to stay on top of your finances.

Xero: Simplified Accounting For Entrepreneurs

Xero is a cloud-based accounting software specifically designed for entrepreneurs and small business owners. With its intuitive interface and simplified features, Xero makes accounting accessible to individuals with limited accounting knowledge. The software allows you to manage invoices, track expenses, and reconcile bank transactions with ease. Xero also offers real-time collaboration, enabling you to work seamlessly with your accountant or bookkeeper. Whether you are just starting out or looking to simplify your accounting processes, Xero provides a user-friendly solution tailored to your needs.

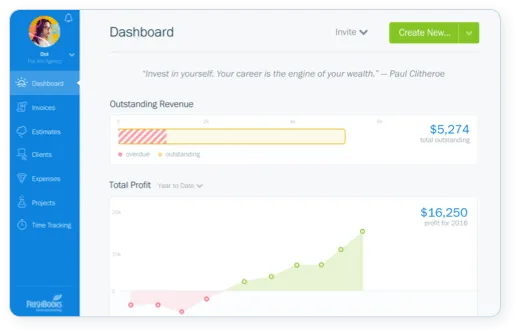

Freshbooks: Ideal For Service-based Businesses

FreshBooks is an accounting software that caters specifically to service-based businesses. Its intuitive features and streamlined interface make it easy to manage client invoices, track time, and generate professional-looking estimates. FreshBooks also offers powerful reporting capabilities, allowing you to gain valuable insights into your business performance. The software integrates seamlessly with popular payment gateways, making it convenient for your clients to pay invoices online. Whether you are a freelancer, consultant, or agency, FreshBooks provides the tools you need to run your service-based business efficiently.

Sage 50cloud: Comprehensive Solution For Growth

Sage 50cloud is a comprehensive accounting software solution designed for businesses that are looking to scale and grow. With its robust features, Sage 50cloud offers advanced inventory management, customizable financial reports, and multi-currency capabilities. The software also provides powerful cash flow management tools, allowing you to forecast and track your cash flow in real-time. With its cloud-based functionality, Sage 50cloud enables you to access your financial data anytime, anywhere. Whether you have multiple locations or complex accounting requirements, Sage 50cloud offers a comprehensive solution to support your business growth.

Evaluating Software Performance

When it comes to choosing the best accounting software for multiple businesses, evaluating software performance is crucial. You want a software solution that not only meets your accounting needs but also performs seamlessly and efficiently. In this section, we will explore three important aspects to consider when evaluating the performance of accounting software: user experience and interface, customization and reporting tools, and customer support and community.

User Experience And Interface

A user-friendly interface is essential for accounting software as it ensures a smooth and intuitive user experience. Software that is difficult to navigate or understand can lead to frustration and errors. Look for accounting software that offers a clean and well-organized interface, with easy-to-use features and intuitive navigation. A visually appealing and user-friendly interface makes it easier for you and your team to manage your financial data effectively.

Customization And Reporting Tools

Customization options and robust reporting tools are vital for accounting software, especially when managing multiple businesses. You should be able to tailor the software to meet the specific needs of your businesses, such as customizing charts of accounts, invoices, and financial statements. Additionally, comprehensive reporting tools allow you to generate detailed financial reports, track key performance indicators, and analyze your business’s financial health. Look for software that offers a wide range of customization options and powerful reporting tools to ensure accurate and insightful financial analysis.

Customer Support And Community

Having reliable customer support is essential when using accounting software for multiple businesses. In case you encounter any issues or need assistance, prompt and knowledgeable customer support can save you time and frustration. Look for software providers that offer various support channels, such as phone, email, and live chat, and ensure they have a reputation for providing excellent customer service. Additionally, a strong user community or online forums can be valuable resources for troubleshooting, sharing best practices, and staying updated with the latest software developments.

Pricing Considerations

Opting for the right accounting software for multiple businesses involves considering pricing implications. The best software should offer scalable pricing plans that align with the needs of each business entity. Evaluate features against costs to ensure optimal value for money.

As a business owner, finding the right accounting software can be challenging, especially when you have multiple businesses to manage. One of the most important factors to consider when selecting the best accounting software for your multiple businesses is pricing. Understanding the pricing structures and conducting a cost-benefit analysis can help you make an informed decision.

Understanding Pricing Structures

Most accounting software providers offer different pricing structures to cater to different business needs. Some providers charge a flat monthly fee, while others charge per user or per business. It’s essential to understand these pricing structures and choose the one that aligns with your business needs.

For instance, if you have multiple businesses, you may want to consider software that charges a flat monthly fee per business rather than per user. This way, you can save money and manage all your businesses under one account.

Cost-benefit Analysis For Multiple Businesses

Before selecting accounting software for your multiple businesses, it’s crucial to conduct a cost-benefit analysis. This analysis involves comparing the cost of the software against the benefits it provides.

When conducting a cost-benefit analysis, consider the following factors:

- The number of businesses you have

- The number of users who will access the software

- The features you need

- The cost of the software

- The time and resources required to set up and maintain the software

By conducting a cost-benefit analysis, you can identify the accounting software that offers the best value for your money and meets your business needs.

In conclusion, when selecting accounting software for your multiple businesses, understanding the pricing structures and conducting a cost-benefit analysis can help you make an informed decision. Choose the software that aligns with your business needs and offers the best value for your money.

Credit: issuu.com

Case Studies

This case study explores the best accounting software for multiple businesses. By analyzing the features, pricing, and customer reviews of top accounting software options, we identify the best choice for businesses with multiple entities.

Success Stories Of Multi-business Accounting

Exploring real-world examples of how accounting software benefits multiple businesses.

Pitfalls To Avoid In Software Selection

Key mistakes to steer clear of when choosing accounting software for multiple businesses.

Making The Switch

When considering the best accounting software for multiple businesses, making the switch can be a critical decision that impacts your organization’s financial operations. Transitioning smoothly between accounting systems and ensuring staff are trained on the new software are key steps in this process.

Transitioning Between Accounting Systems

When moving to new software, data migration and integration are vital for a seamless transition. Ensure compatibility and accuracy during this phase.

Training Staff On New Software

Training staff on the new accounting software is essential for maximizing its benefits. Provide hands-on training and support to facilitate a smooth adoption process.

Credit: www.freshbooks.com

Future Of Accounting Software

The future of accounting software is evolving rapidly to meet the growing demands of businesses managing multiple entities. As technology advances, new features and functionalities are being introduced to streamline accounting processes for multi-business management.

Emerging Technologies In Accounting

Artificial intelligence and machine learning are revolutionizing how accounting software handles data analysis and financial reporting.

Predictions For Multi-business Management

- Increased automation in accounting tasks

- Enhanced data security measures

- Integration with cloud computing for real-time access

Credit: www.freshbooks.com

Frequently Asked Questions

Can I Use Quickbooks For Multiple Businesses?

Yes, QuickBooks can be used for multiple businesses. It allows you to manage and track finances for different companies using one software. This makes it convenient and efficient for business owners with multiple ventures.

Can I Use Freshbooks For Multiple Businesses?

Yes, FreshBooks allows you to use it for multiple businesses. You can easily manage and track the finances of multiple businesses using FreshBooks’ user-friendly platform.

What Software Do Most Companies Use For Accounting?

Most companies use popular accounting software such as QuickBooks, Xero, and FreshBooks for their accounting needs. These software are user-friendly, efficient, and offer a wide range of features for managing financial transactions and reporting.

Does Xero Allow Multiple Companies?

Yes, Xero allows multiple companies. You can easily switch between them and manage their finances separately using a single login. This feature is particularly helpful for business owners who have multiple businesses or franchises.

Conclusion

Choosing the right accounting software for multiple businesses can greatly streamline financial operations and improve overall efficiency. With a variety of options available, it’s important to consider factors such as scalability, user-friendliness, and integration capabilities. By carefully evaluating the needs of your business and comparing features, you can select the best accounting software that aligns with your specific requirements.

Embracing technology in this aspect will undoubtedly contribute to the long-term success and growth of your multiple businesses.