The best oil and gas accounting software is designed to streamline financial processes and ensure compliance with industry regulations. It should provide comprehensive features for managing revenue, expenses, royalties, and joint interest billing.

Oil and gas accounting software plays a crucial role in managing the complex financial aspects of the industry. With the ever-changing regulations and dynamic market conditions, it’s essential to have a robust software solution that can handle the unique accounting requirements of the oil and gas sector.

From tracking production costs to managing lease agreements, the right software can help companies maintain accurate financial records and make informed business decisions. We will explore the key features and benefits of the best oil and gas accounting software to help you choose the right solution for your business.

Introduction To Oil And Gas Accounting Software

Discover the top oil and gas accounting software solutions that streamline financial management for the industry. Optimize your operations with these powerful tools designed specifically for tracking expenses, managing assets, and ensuring compliance.

The Role Of Specialized Accounting In The Energy Sector

The oil and gas industry is one of the most complex and regulated industries globally, which is why specialized accounting software is essential. For businesses in the energy sector, it can be challenging to keep track of all the financial data. Oil and gas accounting software helps companies manage their finances efficiently by providing specific tools that cater to the unique accounting needs of the industry. These software solutions ensure that all financial transactions are recorded accurately, and the financial reporting is compliant with the relevant laws and regulations.

Criteria For Evaluating Software Solutions

Before selecting an oil and gas accounting software solution, businesses must consider the following factors:

- Industry-specific features: The software should have features that cater to the unique requirements of the oil and gas industry, such as joint venture accounting, revenue distribution, and well management.

- Scalability: The software should be scalable to accommodate the company’s growth and changing needs.

- User-friendliness: The software should be easy to use, with an intuitive interface and navigation.

- Integration: The software should integrate seamlessly with the company’s existing systems.

- Security: The software should have robust security features to protect sensitive financial data from cyber threats.

- Cost: The software should be cost-effective, with a reasonable pricing model.

By considering these criteria, businesses can choose the best oil and gas accounting software that meets their accounting needs efficiently.

Credit: www.ifs.com

Key Features Of Oil And Gas Accounting Platforms

When it comes to oil and gas accounting, having the right software can make a significant difference in streamlining operations and ensuring compliance. Oil and gas accounting platforms are designed with specific features tailored to the unique needs of the industry. In this article, we will explore the key features of oil and gas accounting platforms, focusing on joint interest billing capabilities, revenue distribution and tracking, as well as compliance and reporting tools.

Joint Interest Billing Capabilities

Joint Interest Billing capabilities are essential for oil and gas accounting software. These features allow for the accurate allocation of expenses related to joint operations among the partners. The software should provide detailed tracking of costs, automatic calculation of billings, and customizable reporting to meet the specific needs of each partner.

Revenue Distribution And Tracking

Effective revenue distribution and tracking are crucial for oil and gas accounting platforms. The software should enable automated allocation of revenue among partners, comprehensive reporting on revenue streams, and integration with production data to ensure accurate tracking and distribution of revenue.

Compliance And Reporting Tools

Compliance and reporting tools are paramount in the oil and gas industry. The software should offer built-in compliance checks for regulatory requirements, customizable reporting for financial and operational data, and audit trail capabilities to ensure transparency and accountability.

Top Software Picks For 2024

When it comes to managing the complex accounting needs of the oil and gas industry, having the right software in

place is crucial. With so many options available, it can be overwhelming to choose the best oil and gas accounting

software for your business. To help you make an informed decision, we have compiled a list of the top software

picks for 2024. These software solutions have been carefully selected based on their user reviews, industry

ratings, integration capabilities, and data migration support.

Comparing User Reviews And Industry Ratings

User reviews and industry ratings are essential factors to consider when selecting oil and gas accounting

software. They provide valuable insights into the software’s performance, reliability, and overall user

satisfaction. We have analyzed numerous user reviews and industry ratings to identify the top software picks for

2024. These software solutions have consistently received positive feedback from users and have been recognized

for their exceptional performance in the oil and gas industry.

Integration With Existing Systems And Data Migration Support

Seamless integration with existing systems is a critical aspect of any oil and gas accounting software. The

software should be able to effortlessly integrate with your current infrastructure, ensuring a smooth transition

and minimal disruption to your business operations. Additionally, data migration support is crucial to ensure that

your valuable data is transferred accurately and securely to the new software. The top software picks for 2024

offer robust integration capabilities and comprehensive data migration support, making the transition process

seamless and hassle-free.

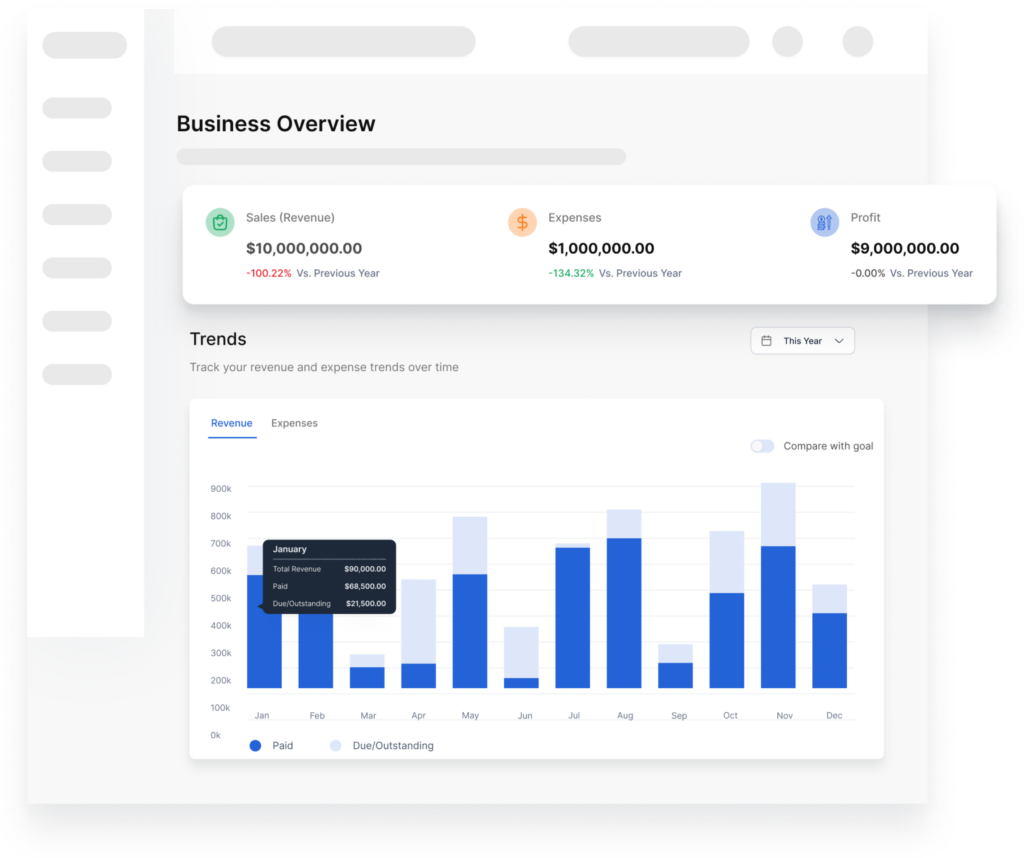

Credit: vencru.com

Customization And Scalability

When it comes to choosing an oil and gas accounting software, customization and scalability are two crucial factors to consider. Customization allows the software to adapt to the unique needs of your company, while scalability ensures that it can grow and evolve along with your operations.

Adapting To Company Size And Operations

One of the key benefits of a customizable oil and gas accounting software is its ability to adapt to the size and operations of your company. Whether you are a small independent operator or a large multinational corporation, the software should be flexible enough to meet your specific requirements.

With the ability to customize the software, you can tailor it to match your company’s workflows and processes. This not only improves efficiency but also ensures that you have access to the features and functionalities that are most important to your operations. Whether you need to track production volumes, manage royalties, or analyze financial data, a customizable software can be tailored to fit your exact needs.

Furthermore, a customizable software allows you to add or remove modules as your company grows and changes. This means that you can start with a basic accounting system and gradually incorporate additional features and functionalities as your operations expand. This scalability ensures that you are not locked into a one-size-fits-all solution, but rather have the flexibility to adapt the software to your evolving needs.

Future-proofing With Scalable Solutions

In the fast-paced world of oil and gas, it is essential to future-proof your accounting software by choosing a scalable solution. Scalability refers to the software’s ability to handle increasing volumes of data and users without compromising performance.

As your company grows, the volume of data you need to manage will inevitably increase. A scalable software can handle large datasets and complex calculations without slowing down or crashing. This ensures that you can continue to process and analyze financial data in a timely manner, even as your operations expand.

Additionally, a scalable solution allows for easy integration with other systems and software. This means that as your company adopts new technologies or implements additional software solutions, your accounting software can seamlessly integrate with them. This integration eliminates the need for manual data entry and reduces the risk of errors, saving you time and improving accuracy.

In conclusion, customization and scalability are two essential features to look for in an oil and gas accounting software. By choosing a customizable solution, you can tailor the software to your company’s size and operations, while a scalable solution ensures that it can grow and evolve along with your business. This combination of customization and scalability allows you to future-proof your accounting software and optimize your financial management processes.

Security Measures And Data Protection

Discover the best oil and gas accounting software for enhanced security measures and data protection. Streamline your operations and safeguard sensitive information with advanced software solutions designed specifically for the industry.

Ensuring Data Integrity And Confidentiality

Oil and gas accounting software handles sensitive financial data that requires confidentiality and data integrity. The software ensures data integrity by providing different levels of security access to authorized personnel, and through encryption of sensitive data. The software also provides audit trails and ensures that transactions are recorded accurately and in real-time.

Compliance With Industry Standards And Regulations

Oil and gas companies are required to comply with various industry standards and regulations, including the Sarbanes-Oxley Act, the Financial Accounting Standards Board (FASB) standards, and the International Financial Reporting Standards (IFRS). The best oil and gas accounting software ensures compliance with these standards and regulations by providing advanced reporting capabilities, including customizable financial statements, balance sheets, and income statements.

Data Backup And Disaster Recovery

Data backup and disaster recovery are critical components of oil and gas accounting software. The software ensures that data is backed up regularly and can be recovered in case of a disaster. The software provides automatic backups, data replication, and off-site storage of data to ensure that data is safe and can be recovered quickly in the event of a disaster.

In conclusion, the best oil and gas accounting software provides advanced security measures and data protection to ensure data integrity and confidentiality. The software also ensures compliance with industry standards and regulations and provides data backup and disaster recovery capabilities. By using the best oil and gas accounting software, companies can improve their financial reporting, reduce the risk of errors, and ensure the safety of their financial data.

Cost Considerations And Roi

When considering the implementation of oil and gas accounting software, it is crucial to assess the cost considerations and potential return on investment (ROI). Analyzing the total cost of ownership and assessing the impact on operational efficiency are key factors in making an informed decision.

Analyzing Total Cost Of Ownership

Understanding the total cost of ownership involves evaluating not just the upfront price of the software but also ongoing expenses such as maintenance, training, and support. It is essential to consider all costs associated with the software over its lifespan.

Assessing The Impact On Operational Efficiency

Implementing oil and gas accounting software can significantly impact operational efficiency by streamlining processes, reducing errors, and improving data accuracy. Assessing how the software will enhance operational efficiency is crucial in determining its overall value.

Implementation And Training Support

Implementing and training on new software are crucial for successful adoption.

Vendor Support During Software Rollout

Vendor support is vital during software implementation for seamless integration.

- 24/7 helpdesk assistance for any queries

- Dedicated account manager for personalized assistance

Resources For Employee Training And Adoption

Employee training resources ensure smooth transition and optimal usage.

- Online tutorials for self-paced learning

- On-site training sessions for hands-on experience

Emerging Trends In Oil And Gas Software

Oil and gas accounting software is rapidly evolving to keep pace with the dynamic industry. Let’s explore the latest trends shaping the landscape of oil and gas software solutions.

Incorporation Of Ai And Machine Learning

AI and Machine Learning are revolutionizing oil and gas accounting software, enhancing efficiency and accuracy.

The Rise Of Cloud-based Solutions

Cloud-based solutions are gaining prominence in the oil and gas sector, offering flexibility and scalability.

User Perspectives And Case Studies

User Perspectives and Case Studies provide valuable insights into the effectiveness of the Best Oil And Gas Accounting Software.

Success Stories From Industry Leaders

Discover how top industry players leverage the software for streamlined operations.

Learning From The Challenges Faced By Early Adopters

Understand the hurdles early users overcame to maximize the software’s potential.

Credit: www.hashmicro.com

Final Thoughts

Discover the best oil and gas accounting software to streamline your financial operations. Gain accurate insights and improve efficiency with advanced features tailored to the industry’s unique needs. Make informed decisions and drive growth with powerful reporting and analytics tools.

Choosing The Right Software For Your Business

When it comes to choosing the best oil and gas accounting software for your business, there are several factors to consider. First, you need to evaluate your specific business needs and goals. Do you need a software that can handle complex financial transactions, or do you need something simpler that can handle basic accounting tasks? Additionally, you should consider your budget, as well as the level of customer support and training that is available with each software option.

One of the most important things to look for in oil and gas accounting software is scalability. Your business needs may change over time, so you want to choose a software that can grow and adapt with you. Additionally, you should consider the software’s compatibility with other programs and tools that you use, such as payroll software or project management tools.

Preparing For The Future Of Oil And Gas Accounting

The oil and gas industry is constantly evolving, and your business needs to be prepared for future changes in accounting practices and regulations. This means choosing a software that is regularly updated to reflect industry changes and can handle new compliance requirements.

Another important factor to consider is the level of automation and integration offered by the software. Automation can help streamline your accounting processes and reduce errors, while integration with other tools can make it easier to manage your business as a whole.

Overall, choosing the right oil and gas accounting software is essential for the success and growth of your business. By taking the time to evaluate your needs and research your options, you can find a software that will help you stay ahead of the curve and achieve your goals.

Frequently Asked Questions

What Is The Best Accounting Software For Gas Stations?

QuickBooks and Xero are the best accounting software options for gas stations. Both offer features such as inventory tracking, invoicing, and payroll management that are essential for gas station businesses. These programs are user-friendly and affordable, making them ideal for small to medium-sized gas stations.

What Is The Accounting For Oil And Gas?

The accounting for oil and gas involves tracking revenue, expenses, and assets related to exploration, production, and distribution. It includes specialized methods for reserves estimation and cost allocation. This ensures accurate financial reporting and compliance with industry regulations.

What Accounting Software Do Accountants Recommend?

Accountants often recommend QuickBooks as their preferred accounting software due to its user-friendly interface, robust features, and extensive integrations with other business tools. QuickBooks allows accountants to efficiently manage finances, track expenses, generate reports, and streamline their clients’ bookkeeping processes.

Which Design Software Is Used In Oil And Gas Industry?

Design software commonly used in the oil and gas industry includes AutoCAD, SolidWorks, and CATIA. These tools are essential for designing equipment, structures, and pipelines for oil and gas extraction and processing.

Conclusion

To sum up, choosing the best oil and gas accounting software is crucial for streamlining financial processes and maximizing efficiency in the industry. With features like automated data entry, real-time reporting, and compliance management, these software solutions offer comprehensive solutions for managing complex accounting tasks.

By investing in the right software, oil and gas companies can improve their financial management, reduce errors, and make informed decisions for sustainable growth. Experience the benefits of advanced accounting software and stay ahead in the competitive market.