Running a small business is exciting but challenging. One critical aspect is tracking expenses. Proper expense tracking helps you understand your financial health. It ensures you make informed decisions. This article will guide you on the best ways to track expenses for your small business.

Credit: www.smartsheet.com

Why Tracking Expenses Is Important

Tracking expenses is crucial for several reasons. It helps you monitor cash flow. It ensures you stay within budget. It also helps you identify areas to cut costs. Moreover, it is essential for tax purposes. Accurate records make tax filing easier and can help you avoid penalties.

Methods to Track Expenses

There are various methods to track expenses. Each method has its pros and cons. Here are the best ways to track expenses for your small business:

1. Manual Tracking

Manual tracking involves recording expenses by hand. You can use a notebook or a ledger. This method is simple and cost-effective. However, it can be time-consuming. It is also prone to human error.

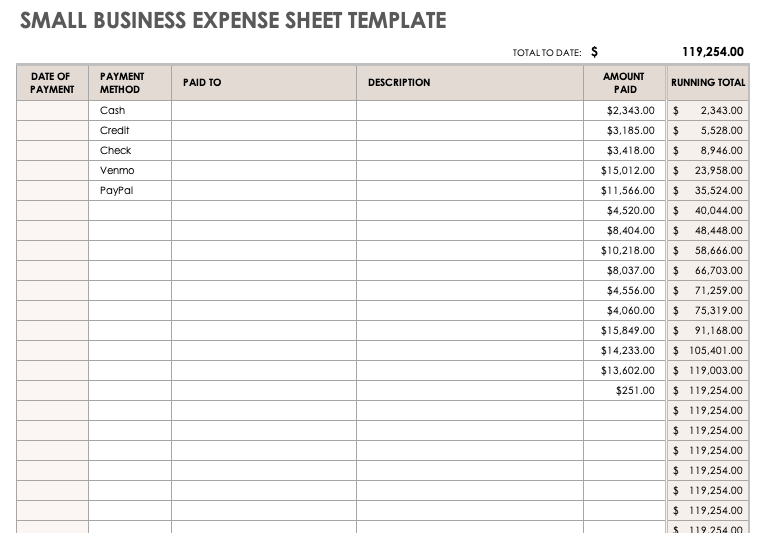

2. Spreadsheets

Spreadsheets are a step up from manual tracking. They offer more organization and flexibility. Programs like Excel or Google Sheets are popular choices. You can create tables and charts to visualize your expenses. However, spreadsheets require some knowledge of formulas and functions.

3. Accounting Software

Accounting software is a powerful tool for expense tracking. It automates many processes and reduces errors. Popular options include QuickBooks, Xero, and FreshBooks. These tools offer features like expense categorization, invoicing, and reporting. They also integrate with bank accounts for seamless tracking.

4. Expense Tracking Apps

Expense tracking apps are convenient and user-friendly. They are designed for small business owners on the go. Apps like Expensify, Zoho Expense, and Receipt Bank are popular choices. They offer features like receipt scanning, mileage tracking, and real-time reporting.

Key Features to Look For

When choosing a method to track expenses, consider the following features:

- Ease of Use: The tool should be easy to use and understand.

- Automation: Automation features save time and reduce errors.

- Integration: The tool should integrate with your bank and other software.

- Reporting: Detailed reports help you analyze your expenses.

- Security: Ensure the tool has robust security features to protect your data.

Best Practices for Tracking Expenses

Implementing the right methods is not enough. You also need to follow best practices. Here are some tips to ensure effective expense tracking:

1. Categorize Expenses

Organize your expenses into categories. Common categories include rent, utilities, supplies, and salaries. This helps you understand where your money is going.

2. Keep Receipts

Always keep your receipts. They provide proof of your expenses. You can use apps to scan and store digital copies of receipts.

3. Reconcile Accounts Regularly

Reconcile your accounts regularly. This ensures your records match your bank statements. It helps you identify any discrepancies or fraudulent activities.

4. Set A Budget

Set a budget for your business. Monitor your expenses against the budget. This helps you stay within your financial limits.

5. Review And Analyze

Regularly review and analyze your expenses. Look for patterns and trends. Identify areas where you can cut costs or improve efficiency.

Frequently Asked Questions

How Can I Track Business Expenses Easily?

Use accounting software like QuickBooks or Xero. These tools automate tracking and simplify expense management.

What Are The Best Tools For Tracking Expenses?

QuickBooks, Xero, and FreshBooks are popular options. They offer comprehensive features for small business expense tracking.

Why Is Expense Tracking Important For Small Businesses?

Expense tracking helps monitor cash flow, ensure accurate tax reporting, and identify cost-saving opportunities.

Can I Use Spreadsheets To Track Expenses?

Yes, spreadsheets like Excel or Google Sheets are effective for manual expense tracking and customization.

Conclusion

Tracking expenses is vital for the success of your small business. Choose a method that suits your needs and follow best practices. This will help you manage your finances effectively. It will also ensure your business thrives and grows. Start tracking your expenses today and take control of your financial future.

Credit: www.bench.co

FAQs

| Question | Answer |

|---|---|

| What is the best tool for tracking expenses? | The best tool depends on your needs. Accounting software and expense tracking apps are popular choices. |

| How often should I reconcile my accounts? | It is best to reconcile your accounts monthly. This helps you stay on top of your finances. |

| Why is it important to keep receipts? | Receipts provide proof of your expenses. They are also essential for tax purposes. |

| Can I use a spreadsheet to track expenses? | Yes, spreadsheets are a cost-effective way to track expenses. They offer flexibility and organization. |