Running a small business can be challenging. One key aspect is keeping track of expenses. This helps you understand your finances better. Let’s learn how to do it efficiently.

Why is Tracking Expenses Important?

Tracking expenses helps you know where your money goes. It helps you make better financial decisions. It also helps you save money and avoid unnecessary costs.

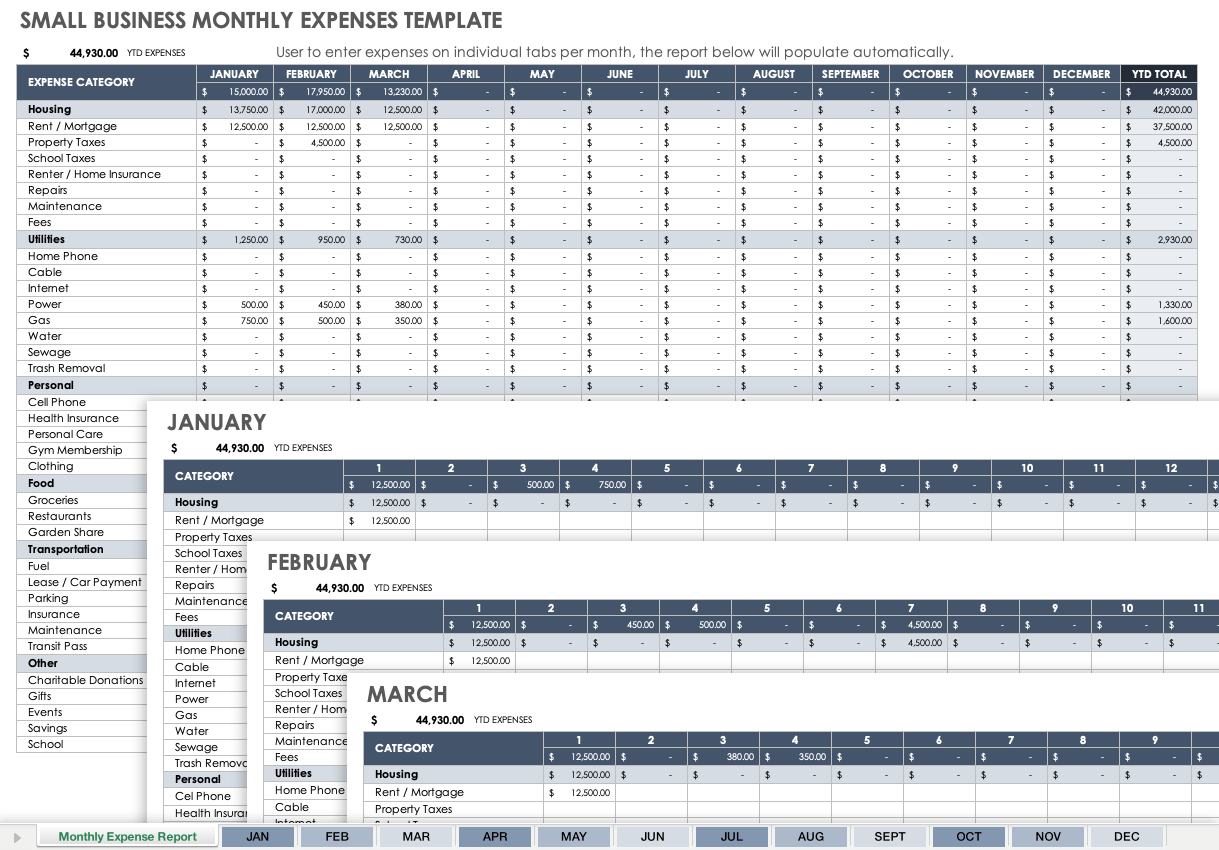

Credit: www.gosite.com

Step-by-Step Guide to Track Small Business Expenses

1. Use Accounting Software

Accounting software is a great tool. It helps you keep all your financial records in one place. Some popular options are QuickBooks, Xero, and FreshBooks.

- QuickBooks: Easy to use and popular.

- Xero: Good for small businesses.

- FreshBooks: Great for freelancers.

2. Keep Receipts And Invoices

Always keep your receipts and invoices. They are proof of your expenses. You can keep them in a file or scan them to store digitally.

3. Categorize Your Expenses

Categorizing expenses makes tracking easier. Some common categories are:

- Office Supplies

- Travel Expenses

- Marketing Costs

- Employee Salaries

4. Use Expense Tracking Apps

Expense tracking apps are very helpful. They can sync with your bank account. Some popular apps are Expensify, Zoho Expense, and Wave.

- Expensify: Great for tracking receipts.

- Zoho Expense: Good for small to medium businesses.

- Wave: Free and easy to use.

5. Set A Budget

Setting a budget helps you control your spending. It ensures you do not overspend. Make a monthly budget and stick to it.

6. Regularly Review Your Expenses

Regular reviews help you stay on track. Set a time every week to review your expenses. This helps you spot any errors or unusual spending.

7. Separate Business And Personal Expenses

Always keep business and personal expenses separate. This avoids confusion. It also makes tax filing easier.

8. Hire A Professional

If you find tracking expenses hard, hire a professional. Accountants can help you manage your finances better.

Credit: www.plooto.com

Tips for Effective Expense Management

- Keep your records organized.

- Use technology to your advantage.

- Stay disciplined with your budgeting.

- Regularly update your financial records.

Common Mistakes to Avoid

- Mixing personal and business expenses.

- Not keeping receipts and invoices.

- Ignoring small expenses.

- Failing to review your expenses regularly.

Frequently Asked Questions

What Are Small Business Expenses?

Small business expenses are costs incurred in running your business. These include rent, utilities, supplies, and wages.

Why Track Business Expenses?

Tracking expenses helps manage cash flow, ensures accurate tax reporting, and identifies cost-saving opportunities for your business.

How To Categorize Expenses?

Categorize expenses into fixed, variable, and periodic costs. This helps in budgeting and identifying spending patterns.

What Tools Can Track Expenses?

Expense tracking tools include accounting software like QuickBooks, FreshBooks, and mobile apps like Expensify and Wave.

Conclusion

Tracking small business expenses is crucial. It helps you manage your finances better. Use the tips and tools mentioned here. Stay organized and disciplined. This will ensure your business runs smoothly.