Do you work as a freelancer or independent contractor? If you do, you need to track your expenses. This is important for your 1099 forms. Let’s learn how to track expenses easily.

What is a 1099 Form?

A 1099 form reports income from self-employment. You get this form from clients. It helps the IRS know how much you earned.

Why Track Expenses?

- Save Money: Tracking expenses can lower your taxable income.

- Stay Organized: Keep your receipts and records in one place.

- Avoid Stress: Being organized helps during tax season.

Types of Expenses to Track

There are different types of expenses. Here are some you should track:

Office Supplies

Did you buy pens, paper, or a printer? Keep those receipts. These are office supplies.

Travel Expenses

Do you travel for work? Keep track of your tickets, gas, and hotel bills.

Meals And Entertainment

Did you have a business lunch? Save the receipt. You can deduct part of these costs.

Utilities And Rent

Do you work from home? Track your rent and utility bills. You can deduct part of these too.

How to Track Expenses

Tracking expenses can be easy. Here are some methods:

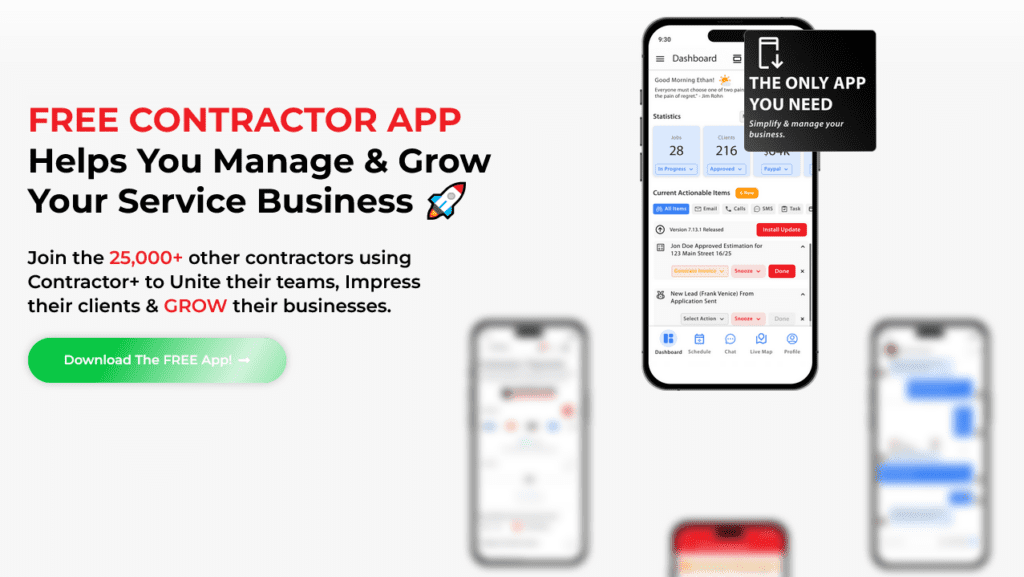

Use An App

There are many apps to track expenses. Some popular ones are:

- QuickBooks

- Expensify

- FreshBooks

These apps help you stay organized. You can take pictures of receipts and add them to the app.

Use A Spreadsheet

Do you like using Excel or Google Sheets? Make a spreadsheet. List all your expenses. Include date, amount, and type of expense.

Keep A Journal

Do you prefer writing things down? Use a notebook. Write down every expense. Keep the receipts in an envelope.

Credit: contractorplus.app

Tips to Make Tracking Easier

Tracking expenses can be simple. Here are some tips:

Do It Daily

Track your expenses every day. It takes just a few minutes. This habit will help you stay organized.

Set Reminders

Set reminders on your phone. This will help you remember to track your expenses.

Keep Receipts

Always keep your receipts. They are proof of your expenses. You can use a folder or an envelope.

Benefits of Tracking Expenses

Tracking expenses has many benefits. Here are a few:

Lower Taxes

Tracking expenses can lower your taxable income. This means you pay less in taxes.

Better Budgeting

You will know where your money goes. This helps you budget better.

Less Stress

Being organized reduces stress. You will be ready for tax season.

Credit: www.hellobonsai.com

Frequently Asked Questions

What Is A 1099 Form?

A 1099 form reports various types of income, like freelance earnings.

How Do I Track 1099 Expenses?

Use a dedicated app or spreadsheet to categorize and log each expense.

Why Track 1099 Expenses?

Accurate tracking helps with tax deductions and financial planning.

What Expenses Are Deductible On 1099?

Common deductions include office supplies, travel, and software subscriptions.

Conclusion

Tracking expenses for 1099 forms is important. It helps you save money and stay organized. Use an app, spreadsheet, or journal. Follow our tips to make tracking easier. Start tracking your expenses today!